What’s driving innovation and why there is a need to focus on the social impact of innovation?

In top 50 innovative countries the count of European countries is highest followed by Asia. Within Central and Southern Asia, India continues to lead, maintaining its 40th position overall. India leads the lower middle-income group.

According to the latest Global Innovation Index report, Switzerland has retained its top position for the 13th consecutive year. Sweden and the United States follow in second and third place, respectively. The United Kingdom and Singapore complete the top five. Finland has moved closer to the top five, while Denmark, Estonia, Latvia, and Lithuania have all shown an upward trend, except for Iceland, which has remained stable at the 20th position. Japan is ranked 13th, while Israel has made it to the top 15. Among middle-income economies, China ranks 12th, followed by Turkey, India, Vietnam, the Philippines, and Iran in the top 65. Saudi Arabia, Brazil, and Qatar have made it to the top 50, while South Africa has entered the top 60. Morocco, Uzbekistan, Egypt, and Pakistan have shown the most progress in the last decade.

In top 50 innovative countries the count of European countries is highest followed by Asia. Within Central and Southern Asia, India continues to lead, maintaining its 40th position overall. India leads the lower middle-income group.

Investments in innovation had a mixed performance in 2022 as they encountered numerous challenges and a drop in innovation finance. In 2022, investments in innovation showed a mixed performance after a boom in 2021. While scientific publications, R&D, venture capital (VC) deals, and patents continued to increase, the growth rates were lower than the exceptional increases seen in 2021. Moreover, the value of VC investment declined, and international patent filings stagnated. In 2022, scientific publications grew moderately, with an increase of 1.5 per cent to around 2 million articles, as health- and COVID-related research slowed down. Global R&D grew strongly at a rate of 5.2 per cent in 2021, almost equal to pre-pandemic growth in 2019. Business R&D grew strongly by 7 per cent, a rate unseen since 2014.

The graph below shows the ranking of GII pillars for the top 20 innovative countries and India. There are 7 pillars based on which the overall GII rank is calculated. Switzerland ranks 1st in Knowledge and Technology Outputs, and Creative Outputs. Sweden holding first position in Business Sophistication and USA in Market Sophistication. In Human and Capital Research, South Korea leads. Singapore ranks first in Institution and Finland in Infrastructure.

India's rank improved to 56 in Institutions in 2023 from 106 in 2014 and China's ranked improved to 43 from 114 in the same pillar.

The green arrow denotes improvement in the GII pillars ranking and the red arrow denotes drop in the ranking.

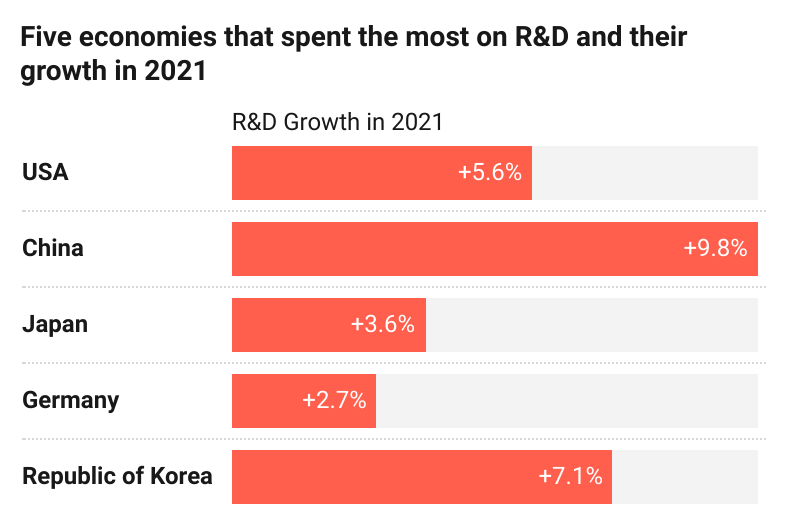

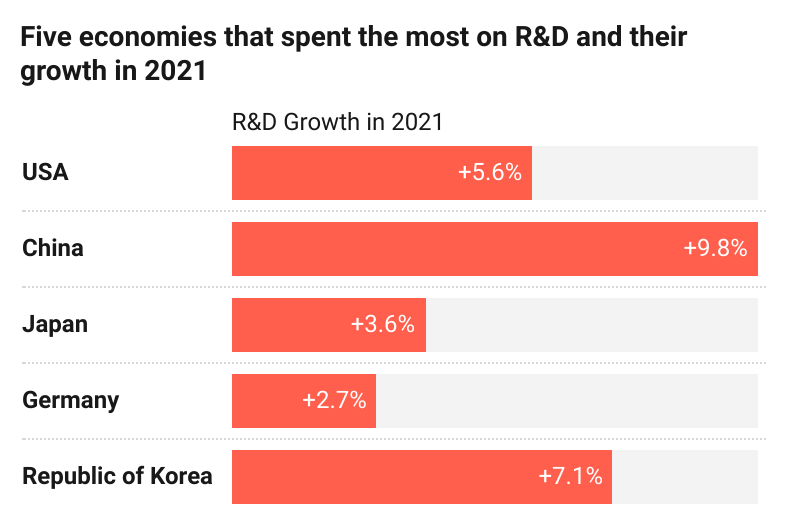

In 2022, the top corporations in the world spent a record high of USD 1.1 trillion on R&D, increasing their expenditure by around 7.4%. While this is a decrease from the 15% growth in 2021, it is difficult to determine whether this nominal growth compensated for surging inflation. The ratio of R&D expenditure to revenue is on par with 2021, indicating that corporations are still R&D-intensive. Global R&D investment grew by 5.2% in 2021, close to the pre-pandemic growth rate of around 6% in 2019. Business R&D expenditure grew by 7% in 2021, the highest rate since 2014. The five economies that spent the most on R&D experienced significant R&D growth in 2021, and most regions have either returned to or surpassed pre-pandemic levels. Government R&D budget allocations grew robustly in 2020, mostly for high-income countries, which are also the biggest R&D spenders, attributable to government efforts to support R&D expenditures as a counter-cyclical measure. However, in 2021, government R&D budgets diverged, with declines seen in Japan and the United States, the two biggest R&D spenders covered. On the corporate side, corporate R&D expenditure worldwide exceeded the trillion-dollar mark for the first time ever in 2022, representing a nominal R&D spending growth of around 7.4% for the year. The nearly 7.5% nominal growth in 2022 in top corporate R&D spend was primarily driven by software and ICT services, ICT hardware and pharma. The seven industry sectors attracting the greatest R&D investment in 2022 were ICT hardware and electrical equipment, software and ICT services, pharmaceuticals and biotechnology, automobiles, construction and industrial metals, industrial engineering and transportation, and travel, leisure, and personal goods. Overall, the global R&D scenario looks positive, with most economies returning to pre-pandemic levels. However, the impact of the pandemic on R&D budgets in low-and middle-income economies remains to be seen.

The graph is showing the economies that spent most on R&D and their growth in 2021 from 2020.

The year 2022 saw a decline in the value of VC investments compared to 2021, but the number of VC deals increased by almost 17.6%, indicating strong activity in the first half of the year. The Asia Pacific region is now on par with Northern America in terms of deal activity for the first time. Despite concerns of a sharp drop in VC investment, the number of deals increased by 17.6% to over 23,000. However, the total amount of money invested in VC decreased sharply by 37.8%, resulting in the average deal value being halved from USD 31 million in 2021 to USD 16 million in 2022. The Asia Pacific region saw VC deal activity on par with Northern America for the first time in history in 2022. Although there were regional differences, with Africa, Latin America, and Europe leading the way with growth in VC deals, only Africa and Latin America experienced growth above 40%. The amount invested in VC decreased from USD 610 billion in 2021 to USD 380 billion in 2022, which is reminiscent of the financial crisis of 2009. Tighter monetary policy, higher interest rates, and elevated inflation contributed to this decline. Only Africa did not see a decline in money invested.

International patent filings stagnated in 2022, recording the slowest rate of increase since 2009, but still achieving a record of around 280,000 filings. Despite rapid technological progress in various fields such as information technology, health, and energy, the socioeconomic impact of this progress remains weak. The Digital Age and Deep Science innovation waves are making significant progress, with supercomputers becoming faster and more energy-efficient, and the cost of genome sequencing and low-emission energy technologies decreasing.

However, the cost of electric batteries rose sharply in 2022 due to the price volatility of required inputs, even though the long-term trend is still downward. The adoption of safe sanitation, connectivity, robots, and electric vehicles is increasing, but penetration for some technologies such as electric vehicles remains low. The socioeconomic impact of innovation continues to be at a low point for the second year in a row, mainly due to the short-term impact of COVID-19. Labour productivity is stagnant, life expectancy has fallen for the second consecutive year, and carbon dioxide emissions continue to rise, with no global reduction in sight.

Since the pandemic, Mauritius, Indonesia, Saudi Arabia, Brazil, and Pakistan have shown the most improvement in rank. According to the Global Innovation Index, the United States, Singapore, and Israel have scored high in several innovation indicators. The US tops the list with 13 out of 80 indicators, followed by Singapore with 11 and Israel with 9. Some middle- and low-income economies have also excelled in certain domains. For instance, Mozambique ranks first in Gross capital formation, Cambodia and Nepal in Loans from micro-finance institutions, Mauritius in Venture capital investors, and the Islamic Republic of Iran in High-tech.

Judging from data available to the GII, technology adoption is growing. Yet penetration often remains low. Fostering adoption in some sectors, such as agri-food, green or medical innovations, poses a significant challenge. Novel, demand-led innovation approaches, plus new regulatory set-ups and other fresh efforts are required. Measures of the socioeconomic impact of innovation suggest weak, if not declining, progress in recent years. To a large extent, this reflects the impact of the COVID-19 pandemic. How strongly they will rebound, as once the impact of the pandemic recedes, remains an open question.

Economists and policymakers worldwide have been struggling with low productivity growth and how to revive the broken link between innovation and productivity. In 2020, global labour productivity saw a sharp increase of almost 4%, but this productivity spike was short-lived. The less productive, in-person service activities were the most affected by lockdowns, which artificially raised the aggregate economy productivity level rather than being a result of underlying technological progress. Consequently, hopes for a productivity revival were dashed again when employment was readjusted. Output per hour worked declined once again in 2021 to about 1% growth and then down to zero in 2022 - the lowest growth rate seen in decades. In addition to volatile output and employment data, changes in inflation, as well as geopolitical tensions, have also influenced productivity measures. Forecasts for 2023 predict a modest uptick in productivity to about 1%, dampened in particular by negative productivity readings in Europe and the United States. Prospects for 2024 and beyond look better but remain highly uncertain. Whether the Digital Age and Deep Science innovation waves will reverse this productivity crisis continues to be a matter of debate.

COVID-19 resulted in the first observed decline in life expectancy in 2020, and this trend continued in 2021. Life expectancy was almost two years lower in 2021 (71 years) compared to pre-pandemic levels (73 years in 2019). Examining well-being in ageing and the role of innovation also involves reviewing the development of healthy life expectancy - an important measure of what people aspire to. Japan has the longest healthy life expectancy beyond 60 years of age, with an additional 14 years of healthy living plus a further 10 years of less healthy living. Among the 183 countries covered, 30 have more than 10 years of healthy living beyond 60 years of age, while 55 have a life expectancy of under 60 years.

Strict lockdowns and travel restrictions resulted in a significant reduction in global carbon dioxide (CO2) emissions in 2020. Unfortunately, there was a notable rebound in 2021, with emissions increasing by 5.3%, more than reversing the pandemic-induced decline. In 2022, the growth of CO2 emissions slowed again to 1.7% growth over 2021 - which is still higher than the 10-year trend of 0.7%. Comparing the first five months of 2023 to those of 2022, the increase in CO2 emissions appears very modest, with 0.3% growth. However, the data are provisional, and growth is still positive with no global reduction in CO2 emissions in sight.

The current global landscape, influenced significantly by the COVID-19 pandemic and its aftermath, calls for a shift in our approach to innovation. While technology-driven innovation has been a cornerstone of modern progress, the ongoing challenges with stagnant labour productivity, diminishing life expectancy, declining accessibility to crucial healthcare infrastructure like cancer treatment, and a persistent struggle to reduce carbon dioxide emissions underscore the need for a transition towards social impact-driven innovation.

Fostering innovation that prioritises social impact involves reimagining our focus and directing resources towards solutions that improve the well-being and livelihoods of individuals and communities. Addressing the gaps in cancer therapy accessibility, enhancing healthcare infrastructure, and prioritising healthcare access for all are critical facets of this shift. Additionally, embracing innovation that not only enhances productivity but also ensures sustainable growth, reduces inequalities, and enhances overall societal welfare is imperative.

A balance must be struck between technological advancements and their real-world implications, with an emphasis on inclusivity, equity, and sustainability. Policymakers, economists, researchers, and innovators need to collaborate in shaping a future where innovation aligns with the pressing needs of our society. This means investing in innovation that not only drives economic growth but also directly enhances the quality of life for individuals, promotes equality, and protects our environment. By pivoting towards social impact-driven innovation, we can strive for a more equitable and sustainable world that benefits all.